IT Distribution Revenues Remained Under Pressure In Q4 2023, According to IDC

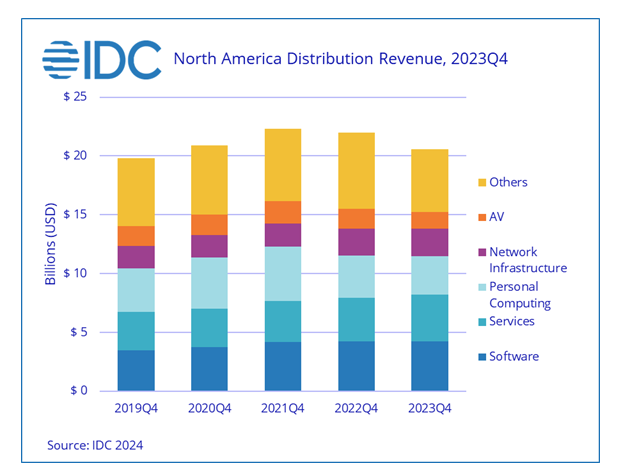

IT distributor revenue declined 6.2% year over year to $20.6 billion in the fourth quarter of 2023.

This marked the fifth consecutive quarter of year-over-year revenue decline coming after nine quarters of growth that followed the beginning of the COVID pandemic in early 2020.

During this period, enterprise spending, including software and services (the largest categories in IT Distribution) as well as networking, have seen consistent growth.

Ruth Flynn, research vice president, IDC Tracker & Data Products

IT distributor revenue declined 6.2% year over year to $20.6 billion in the fourth quarter of 2023 (4Q23), according to the IDC North America Distribution Tracker (NADT). This marked the fifth consecutive quarter of year-over-year revenue decline coming after nine quarters of growth that followed the beginning of the COVID pandemic in early 2020. During this period, enterprise spending, including software and services (the largest categories in IT Distribution) as well as networking, have seen consistent growth. Consumer categories, such as personal computing, audio/video (AV), imaging, consumer electronics, and peripherals and accessories enjoyed a surge in spending during the pandemic but have recently been declining from pandemic highs.

"Recovery and repercussions of the pandemic continue to impact the IT distribution market going into 2024," said Ruth Flynn, research vice president, IDC Tracker & Data Products. "From macro conditions like stabilizing inflation to the drivers of technology spending in enterprise and slow consumer markets we continue to see the market adapting to the pandemic disruption. Despite the difficult current environment, we expect overall IT distribution spending to see growth later in the year, and to see much stronger growth from some categories and vendors."

The fourth quarter and particularly December is always a significant time of year for software sales. While December 2023 came in a bit soft, for the quarter overall software sales through distribution grew 1.1% year over year to $4.27 billion. Over 50% of software sales through distribution were for System Infrastructure Software. This includes the Security software category where Palo Alto recorded strong sales and year-over-year growth of more than 100%. Storage software sales were also strong, with Nutanix achieving 21% year-over-year revenue growth.

After five consecutive quarters of double-digit year-over-year growth, the Network Infrastructure product group has cooled off to just to just 1.7% year-over-year growth as pandemic backlogs have been cleared. The quarter closed with $2.37 billion in sales with Ethernet Switches still showing year-over-year growth of 9.5% but Wireless LAN contracted significantly with a 30% year-over-year decline in revenues.

Contraction in the Personal Computing product group slowed from double-digit decline in previous quarters to a 7.6% year-over-year decline in 4Q23. With total sales of $3.3 billion, the market has settled back to pre-pandemic levels. And while reduced sales for PC peripherals and other consumer devices have persisted into 4Q23, hopefully this trend is an indicator of increased sales for PCs in 2024.